Contrasting the most effective Secured Credit Card Singapore Options for 2024

Contrasting the most effective Secured Credit Card Singapore Options for 2024

Blog Article

Revealing the Opportunity: Can Individuals Discharged From Personal Bankruptcy Acquire Credit Score Cards?

Understanding the Effect of Bankruptcy

Upon filing for insolvency, people are challenged with the substantial repercussions that penetrate different facets of their financial lives. Insolvency can have a profound impact on one's credit report, making it challenging to access credit rating or car loans in the future. This financial stain can linger on credit rating reports for several years, influencing the individual's ability to safeguard desirable rates of interest or monetary chances. Furthermore, personal bankruptcy may lead to the loss of possessions, as specific ownerships might require to be sold off to pay off financial institutions. The psychological toll of personal bankruptcy should not be underestimated, as people might experience sensations of shame, tension, and guilt as a result of their economic circumstance.

Moreover, bankruptcy can restrict employment opportunities, as some employers perform credit scores checks as part of the hiring procedure. This can position an obstacle to individuals seeking brand-new task leads or job improvements. In general, the impact of insolvency extends past financial restrictions, influencing different elements of a person's life.

Factors Affecting Charge Card Authorization

Complying with insolvency, people often have a reduced credit history rating due to the unfavorable impact of the insolvency declaring. Credit rating card business typically look for a credit report score that shows the candidate's capacity to handle debt properly. By meticulously taking into consideration these factors and taking steps to reconstruct credit post-bankruptcy, individuals can improve their potential customers of obtaining a credit card and functioning towards monetary recuperation.

Steps to Restore Credit After Insolvency

Restoring credit history after bankruptcy calls for a critical strategy concentrated on financial self-control and regular debt management. The very first action is to evaluate your credit rating report to ensure all debts included in the personal bankruptcy are properly shown. It is essential to establish a spending plan that focuses on financial debt repayment and living within your methods. One efficient technique is to acquire a safe bank card, where you transfer a specific amount as security to develop a debt restriction. Prompt payments on this card can demonstrate accountable credit history usage to potential loan providers. In addition, take into consideration ending up being an accredited individual on a member of the family's debt card or discovering credit-builder lendings to more boost your credit history. It is vital to make all settlements on schedule, as settlement history considerably influences your credit report. Persistence and determination are key as reconstructing credit history requires time, however with dedication to seem financial techniques, it is feasible to boost your creditworthiness post-bankruptcy.

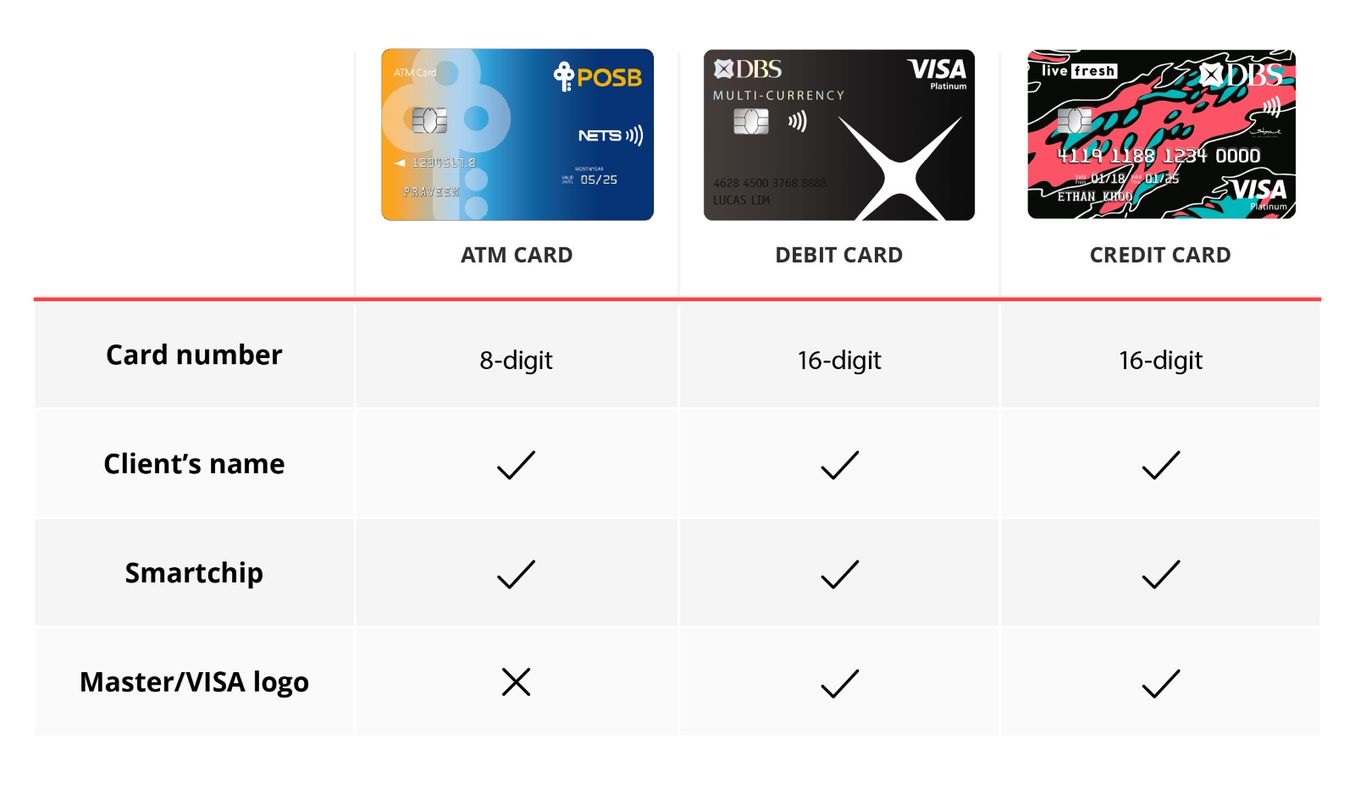

Safe Vs. Unsecured Debt Cards

Adhering to insolvency, people often take into consideration the choice between safeguarded and unsafe bank card as they intend to reconstruct their credit reliability and economic stability. Secured charge card call for a money down payment that acts as security, usually equivalent to the credit history limit provided. These cards are less complicated to acquire post-bankruptcy because the down payment decreases the threat for the company. Nonetheless, they may have higher charges and rates of interest compared to unsafe cards. On the various other hand, unsafe bank card do not require a down payment yet are more difficult to get approved for after personal bankruptcy. Providers evaluate the applicant's creditworthiness and may supply reduced fees and rate of interest rates for those with an excellent economic standing. When choosing in between both, people must evaluate the benefits of less complicated approval read here with secured cards against the prospective costs, and take into consideration unsafe cards for their long-term financial objectives, as they can aid restore credit history without linking up funds in a deposit. Inevitably, the choice between protected and unsafe charge card should straighten with the individual's monetary purposes and capability to take care of credit history properly.

Resources for People Seeking Credit Reconstructing

One valuable resource for individuals looking for credit score restoring is credit score counseling firms. By functioning with a credit counselor, individuals can get understandings into their credit records, discover approaches to enhance their credit history ratings, and obtain guidance on managing their finances properly.

Another handy resource is credit scores surveillance solutions. These solutions permit individuals to keep a close eye on their debt reports, track any mistakes or modifications, and find prospective indicators of identity burglary. By monitoring their credit scores consistently, people can proactively attend to any problems that may arise and ensure that their credit rating information is up to date and accurate.

Furthermore, online devices and resources such as credit report simulators, budgeting apps, and economic proficiency sites can give people with valuable info and tools to aid them in their credit score restoring journey. secured credit card singapore. By leveraging these resources efficiently, people discharged from personal bankruptcy can take significant actions in the direction of enhancing their credit scores wellness and protecting a better financial future

Conclusion

Finally, individuals discharged from personal bankruptcy might have the possibility to get charge card by taking actions to rebuild their credit report. Aspects such as credit history, revenue, and debt-to-income proportion play a considerable role in bank card approval. By understanding the impact of personal bankruptcy, choosing in between safeguarded and unprotected bank card, and utilizing sources for credit rating rebuilding, individuals can improve their credit reliability and potentially obtain accessibility to charge card.

By functioning with a debt counselor, people click over here now can get understandings right into their credit rating reports, discover techniques to improve their credit scores, and get support on managing their financial resources properly. - secured credit card singapore

Report this page